Banknote collectors have encountered some banknotes that they can't always localise.

This goes for the MMM-notes of Sergi Mavrodi.

|

| Sergei Mavrodi |

It all started around 1989, when the MMM's started a company that imported computers and office equipment. However, they were accused of tax evasion. He needed funds to finance his operations and switched to the financial sector. At first he was not successful at all.

Until 1994, when he created a 'succesful' Ponzi scheme.

A Ponzi scheme is a faudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from any actual profit earned by the individual or organization running the operation. It was named after Charles Ponzi a a jewish-Italian business man who used the technique for the first time on big scale in the 1920's in the United States.

|

| Charles Ponzi after his arrestation |

Ponzi however didn't invent it, since Charles Dickens's 1857 novel Little Dorrit already described such a scheme. Ponzi's operation took in so much money, that it became know throughout the States as the Ponzi's scheme.

In fact, it is quite similar to a pyramid game or pyramid scheme. Although there are differences.

In a pyramid scheme, one has to find a number of people who want to join the scheme.

In fact, it is quite similar to a pyramid game or pyramid scheme. Although there are differences.

In a pyramid scheme, one has to find a number of people who want to join the scheme.

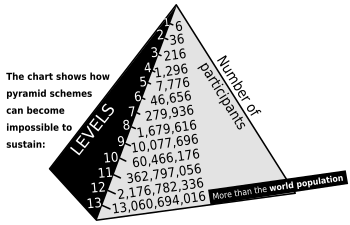

Imagine you have to find 6 participants.

Each of them have to give you something, one Euro, one Dollar, one token ...

So in your first action, you will get 6 Euro. Now the 6 people who are new in the game, have to search each of them 6 new people. They will give each of them 1 token, so the second generation will receive each 6 tokens, although the only invested 1 token to the 1st generation.

The second generation now has to look each of them for 6 new people... this involves already 216 people.

So far, not much 'damage' is done...

Imagine now that you don't get paid by the 'generation' that you generate, but you only get paid after 5, 6, 7, ... generations. The new generation pays the top person in the pyramid and take him off the list, so everyone moves up one generation.

Briefly said, if the scheme holds on for 5 generation, you'll get 7,776 tokens; if you are paid after 6 generations, you'll receive 46,656 tokes. Not bad for a 1 token investment.

However .... this involes already 46656 + 7776 + 1296 + 216 + 36 + 6 = 55980 people!

However .... this involes already 46656 + 7776 + 1296 + 216 + 36 + 6 = 55980 people!

By the time the 6th generation has reached level one ... (and start to receive the tokens), already 2 billion 'new' people are needed and over 2,6 billion people are involved.

Chain letters are also an example of piramid schemes.

A ponzi scheme is slightly different.

As in the pyramid scheme you have to look for 'successors' yourself, the revenue is depending on the succes of the newly added participants.

In a ponzi scheme, you get a fixed percentage of profit and the "owner" is adding investors to the system.

As a small investor, you get a high profit, without having to do anything yourself.

As a small investor, you get a high profit, without having to do anything yourself.

If a pyramid game becomes 'impossible', a ponzi scheme in fact is just a rip-off.

Investors get paid with the investments of new contributors. Or with their own invested money.

MMM created its successful Ponzi scheme in 1994

They promised hughe profits to all investors within a short period of time. Profit rates of 1000% per month.

This led to an enormous rush to the MMM-banks who accepted the russian rubles in exchange for the MMM-shares (notes). At a certain moment, the company was taking in over 100 billion rubles A DAY !

(50 million USD). The cashflow was that enormous that money was no longer counted as money, but in 'rooms': 1 room of money, 2 rooms of money, ...

|

| 1 room of money ... |

On July 22, 1994, the police closed the offices of MMM for tax evasion. For a few days the company attempted to continue the scheme, but soon ceased operations. At that point, Invest-Consulting, one of the company's subsidiaries, owed more than 50 billion rubles in taxes (USD 26 million), and MMM itself owed between 100 billion and 3 trillion rubles to the investors (from USD 50 million to USD 1.5 billion). In the aftermath at least 50 investors, having lost all of their money, committed suicide.

In August 1994 Mavrodi was arrested for tax evasion. However, he was soon elected to the Russian State Duma, with the support of the "deceived investors". He argued that the government, not MMM, was responsible for people losing their money, and promised to initiate a pay-back program. The amount ultimately paid back was minuscule compared to the amount owed.

In October 1995, the Duma cancelled Mavrodi's right to immunity as a deputy. In 1996, he tried to run for Russia's presidency, but most of the signatures he received were rejected. MMM declared bankruptcy on September 22, 1997.

He was placed under police custody in 2003, then was convicted of holding a fake passport and sentenced to 13 months in prison. While in custody he was also investigated over tax evasion and fraud charges that came to light in 1994 and 1995. Mavrodi tried to delay sentencing announcement of his criminal case. Court hearings on the fraud charges began in March 2006. On April 28, 2007, the Moscow court sentenced Mavrodi to four and a half years in a penal colony. The court also fined Mavrodi 10,000 rubles ($390).On May 22, 2007, Mavrodi left prison, serving full sentence.

In 2008 a similar fraude by a ponzi scheme was used by Bernard Madoff in the United States.

|

| B. Madoff |

In 2011 Mavrodi is back in business, having ideas for new MMM-investments, in Russia and Ukraine.

to be continued...

No comments:

Post a Comment